The Green Bottle Model, an approach for equitable access to Mental Health

The realities of capitalism are complex and can feel overwhelming, creating vast disparities in access and opportunity. Capitalism is very real, and it has an impact on mental health for all of us. As a provider, I am acutely aware of these complex pressures. While I wish that we could separate the need for help from the need for payment, I know that's not our reality in our current paradigm. This sliding scale is an honest acknowledgement of that tension. It is a way to honor your unique circumstances while providing an empowering path forward.

I believe in empowering my clients to find agency and choice in all aspects of their lives, and that includes financial decisions. The goal of this sliding scale is to provide a framework that honors your lived experience in regard to personal financial situation, while also ensuring that therapy is accessible to those who need it most. This approach is rooted in my belief that mental health support is a fundamental right, not a luxury. And it is also balanced with the understanding that I am offering a high-value service.

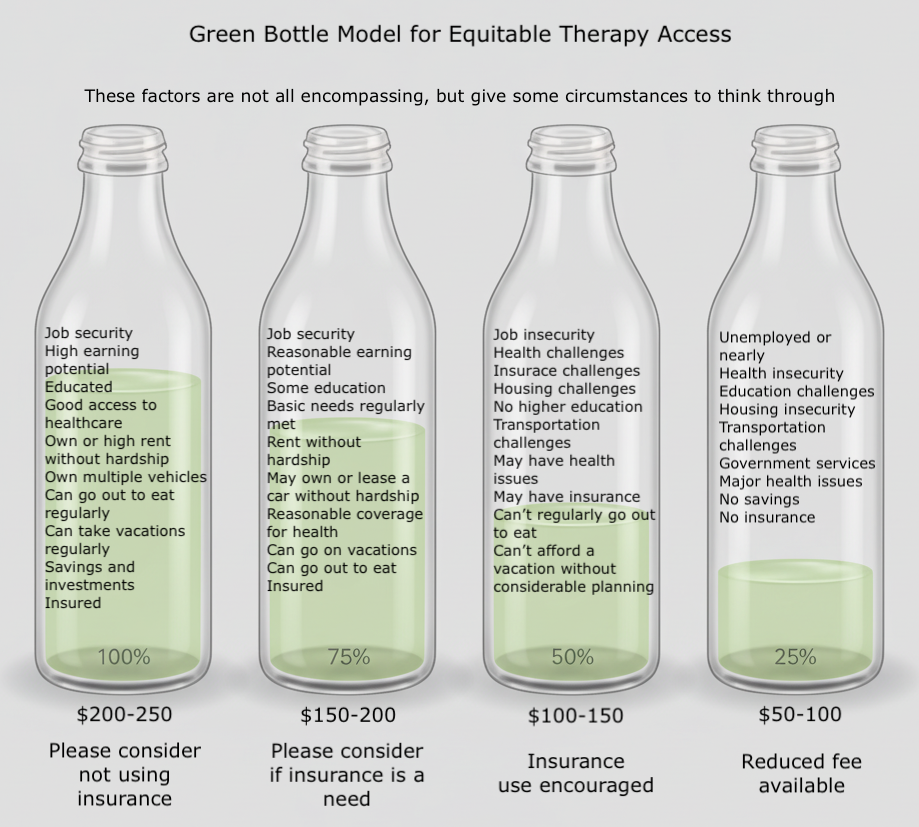

I offer a modified "Green Bottle" sliding scale model, adapted from Alexis J. Cunningfolk (https://www.wortsandcunning.com/blog/sliding-scale). This model asks you to consider your financial circumstances and privileges and use this information to inform a conversation about which fee feels right for you. I will not ask for any financial documentation. I trust you to choose the option that most honestly reflects your lived experience. Below you'll find descriptions to help you determine where you land.

The Sliding Scale “Bottles”

The Green Bottle Model, 4 ranges of circumstances reflecting financial standing

This model is a guide, not a rigid set of rules. It's an opportunity to reflect on your financial context and make an empowering choice about your care. It’s meant to be the starting point for discussion.

Full Bottle ($200-$250)

This range is for individuals who are comfortably meeting their basic needs and have financial security.

You have an expendable income that allows for regular purchases, travel, and recreation.

You may own your home, or rent in the high-end market.

You have investments, or access to financial savings.

You have passive income at a notable level.

You are gainfully employed or have no need to work.

You may have received a sizeable inheritance or company payout that has removed uncertainty about your financial future.

You can afford to invest more in your health and personal growth.

One example of this is if you don’t have to think or check your finances when thinking about going to dinner, choosing a restaurant, or the cost of items on the menu.

You are able to make larger impulse purchases without concern.

You own more than one car, more than one home, etc…

At this range, I ask that people not use insurance to pay for sessions. I am happy to provide a superbill to help ease the cost and utilize insurance assistance.

Mostly Full ($150-$200)

This range is for individuals who are able to meet their basic needs but may have some financial stress about future goals.

You are safely employed, but may not have significant savings or expendable income.

You can afford to take an annual vacation without financial hardship.

You have access to healthcare and some financial savings, but it's not a guarantee for your future.

Owning or leasing a car, and making your monthly rent, do not cause you stress or hardship.

At this range, I ask people to consider if they can afford therapy with a superbill at a reduced rate, rather than using insurance.

Half Full ($100-$150)

This range is for individuals who regularly meet their basic needs but experience stress around doing so.

You may be underemployed, have significant debt, or have limited access to savings.

You may feel that your employment is insecure.

Taking time off for care or a vacation requires active saving and planning.

You cannot spend without thinking about the impact on your future.

Owning or leasing a car causes you some stress.

Paying your rent may sometimes be stressful.

You have limited expendable income for regular extras.

I am happy to take insurance for people that land in this range.

Least Full ($50-$100)

This range is for individuals who are not always able to meet their basic needs and experience a high degree of financial stress.

You may have unstable housing or be unemployed.

You qualify for or receive government assistance.

You have little to no expendable income.

You have no savings, and no “safety net” from your social supports.

You may not have access to health insurance.

I am happy to take insurance, or discuss a very low cost option for therapy sessions for people who land at this range.

Investing in Your Well Being

I also ask that you consider what "investing" means for you. My services are designed to offer rapid empowerment and lasting change, which can pay dividends in the long run of your life. This is not just a fee for a session; it's an investment in your agency and choice for your future.

Many factors other than income and employment affect ability to pay for sessions. Please also consider the following:

Consider investing less if you:

Are supporting dependents.

Have medical expenses not covered by insurance.

Are experiencing employment difficulty due to incarceration history.

Experience discrimination in hiring or pay level.

Have been systematically disempowered

Are descended from enslaved people or Indigenous Americans.

Consider investing more if you:

Have investments, retirement accounts, or inherited money.

Have access to savings or family resources in times of need.

Are employed or underemployed by choice.

Have a high degree of earning power due to education.

Money can be a difficult topic, and I am always happy to discuss this with you. In fact, I believe financial health is part of mental health.

As always, if you have any questions, please reach out!